The email thread behind the most successful acquisition of all time 📸

Handle with care: contains leaked emails, one amazing meme and the best piece of content I found this week

TL;DR

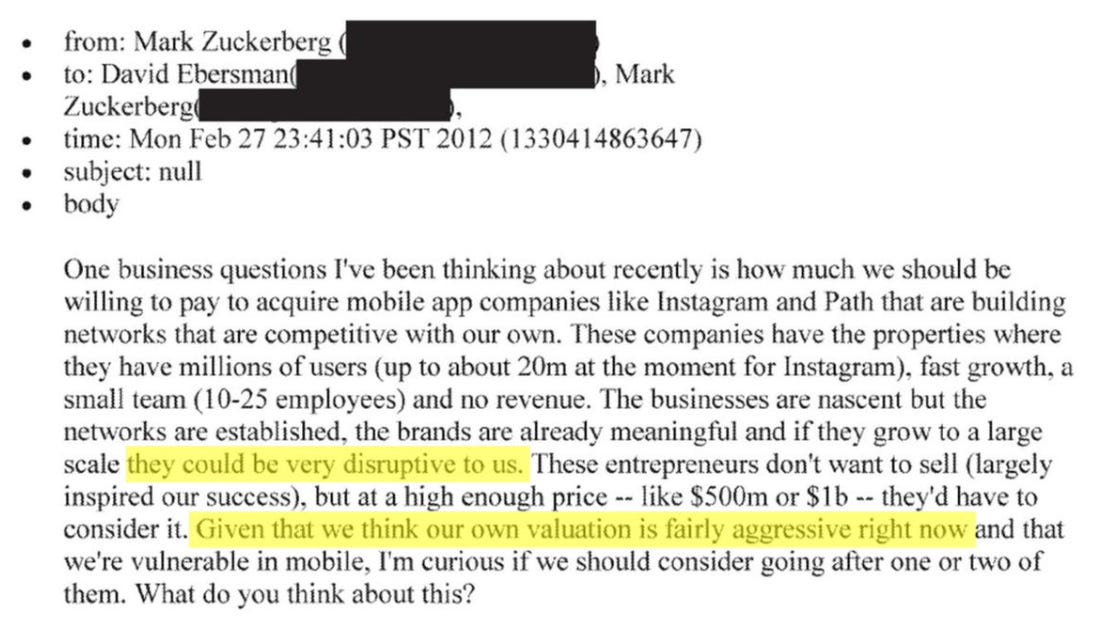

📮 The leaked email thread between Zuckerberg and Facebook CFO in 2012

🤓 A majestic Zuckerberg meme handcrafted by me

🕵️ One of the best pieces of content I found on the Internet this week

An email thread that can not only inspire all founders out there, but also teach everyone a lesson in decision-making under uncertainty.

An email thread illustrating the strategic thinking behind one of the most successful tech acquisitions of all time: Facebook’s purchase of Instagram in 2012.

The acquisition was considered crazy at that time due to its price ($1 Billion 💸).

Instagram had around 30 million users, 13 employees and zero revenues.

At the time, it was an incredible price for a company which had just closed a funding round with a valuation of $500 million days before the deal.

Fast forward to today, Instagram has 2 billion users, hundreds of employees - led by former Facebook Product VP Adam Mosseri, and around $40 billion revenues in 2023.

🥷 Practically, the deal was a steal.

Ok, now with the email thread:

Facebook CEO Mark Zuckerberg emails his CFO, David Ebersman

Feb 2012 - Zuckerberg opens up on the idea of buying mobile app companies that are rapidly growing their networks, recognizing Facebook’s vulnerabilities (“they could be very disruptive to us” and “we’re vulnerable in mobile”).

Zuckerberg understands that:

Building a brand > Building a business model

Instagram created something that people loved (“brands are already meaningful”).

Monetization will eventually come at a later stage, as it did for Facebook.

CFO responds

CFO thoughtfully responds in “corporate”, noting that most M&A deals fail to create the value expected (which might not be entirely true and it depends the specific deals being compared).

However, he recognizes scenarios where an acquisition could be a good idea:

neutralize competition

specialized talent acquisition

products integration

Zuckerberg’s response

Zuckerberg’s response to CFO shows his deep understanding of the market and the potential directions it might follow.

Two main takeaways here:

There are only a finite number of social mechanics to invent. Once a company wins at a specific mechanic, it is very hard for others to replace them without bringing something equally new and disruptive.

Zuckerberg thinks buying Instagram is like buying time.

Specifically, the concept of "buying time" is often undervalued because its impact is not easily quantifiable, yet it is what made the difference here.

“Buying time” here does not mean delaying a decision (i.e. stalling).

It’s actually quite the opposite.

It means recognizing that taking action NOW can save valuable time, whereas delaying the decision will generate greater costs in the future.

Zuckerberg’s follow-up

Facebook was aware of the evolving social dynamics (as stated in the acquisition announcement note: “For years, we’ve focused on building the best experience for sharing photos with your friends and family”) and was planning to implement those already.

However, acquiring a company that had already mastered these dynamics allowed Facebook to incorporate Instagram innovations into their core products, without worrying too much about potential new entrants.

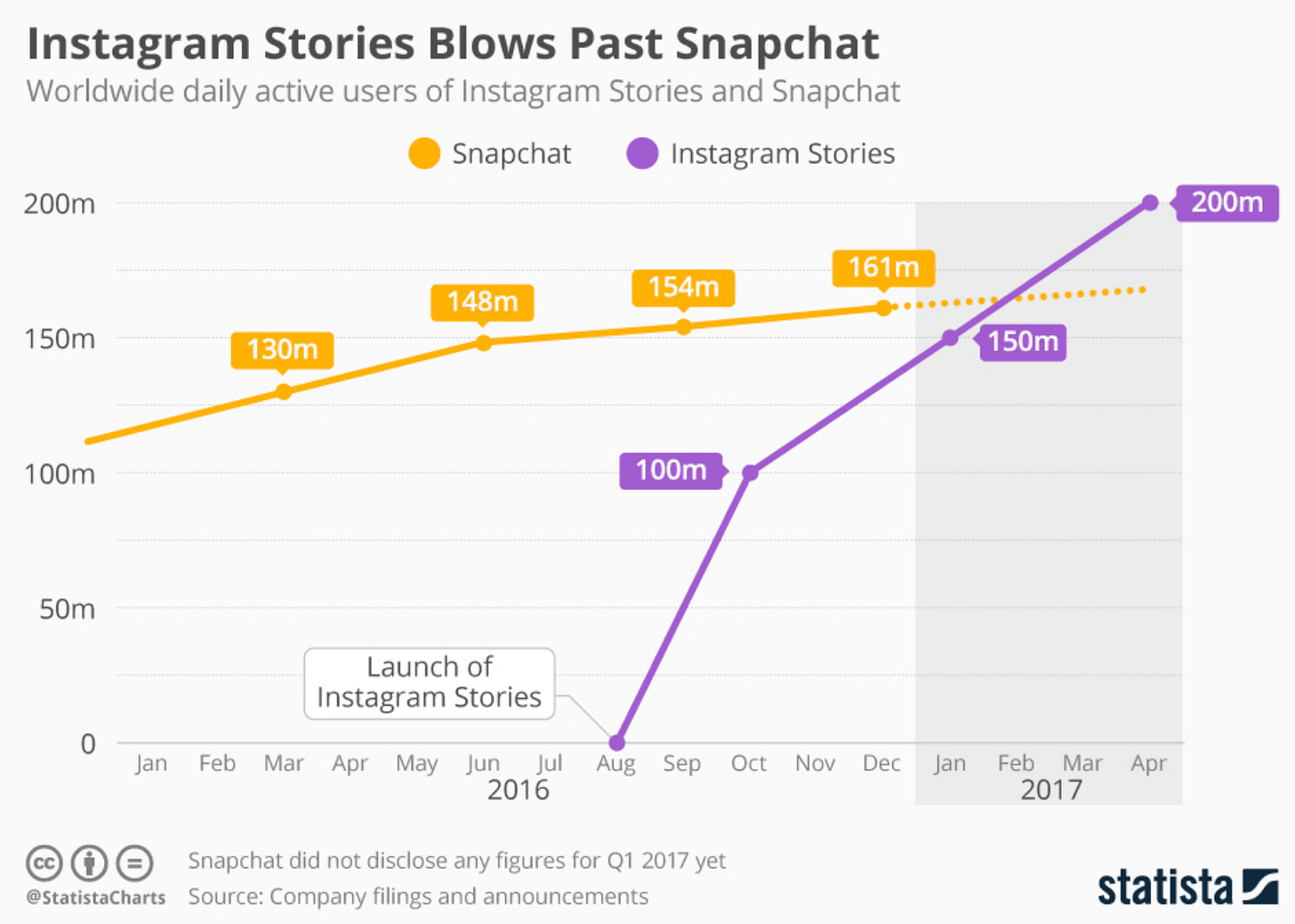

And the “time bought” allowed Facebook to get both the knowledge and the agility to respond to new emerging trends, such as Snapchat’s stories, when the time came.

We did not know how the email thread continued, but within a little over a month - and after Twitter offered $500 million to buy it on April 6, 2012 - Facebook announced the acquisition of Instagram, “a fun, popular photo-sharing app for mobile devices”.

Back in 2012, Facebook generated little revenue from mobile devices and risked being dethroned by mobile-first platforms such as Twitter and Instagram itself.

Buying Instagram showed the world that Zuckerberg and Facebook were serious about dominating the mobile ecosystem.

Facebook gained not only a popular platform, but also bought time to (i) solidify its position in the market, (ii) neutralize potential competitors, and (iii) adapt to evolving user preferences.

History proved them right.

🎁 So, what are the takeaways for founders and the lessons for decision making?

Well, if anything, we could see the strategic thinking of one of the greatest tech CEOs (28-year old at the time) and now 4th richest person in the world.

And this is a gold takeaway per se.

But I see at least three key takeaways:

🙏 always recognize your vulnerabilities

🤝 seize opportunities taking calculated risks

⏱️ the importance of looking beyond short-term goals (besides, delaying a decision will often cost more money than initially thought)

See you next Sunday 🗓️

Thanks,

Giacomo

EXTRA - What I loved this week 🕵️

The best piece of content I found on the Internet this week is by Simon Squibb.

He is a British entrepreneur, investor, and philanthropist that started his first business while homeless at just 15 and later sold his agency, Fluid to PwC for “more money than he’ll ever need”.

In the video He claims to share his 30 years of knowledge in just 2hrs and 26 mins.

He delivers.

You can't beat learning from history and even better, when you can get into the details of how strategic decisions were made. What a great way to learn!

This is great stuff…to get in to the minds of the people when they are discussing such a generation changing deal is insane…thanks for sharing this and your bang on analysis